Is Your Portfolio Company Thriving in the Face of Declining Defense Budgets?

In the shadow of giants, strategic acquisition can be a powerful strategy for midsized firms

By Patrick L. Huddie, Partner, Westbury Group LLC

- Declining defense budgets will drive down margins for commodity services; incumbent contractors will face lower profitability and market value.

- Companies with proprietary technologies, products and services that match the DoD’s strategic priorities will command better margins and hence be more valuable to acquirors.

- To survive incumbent government contractors should shed low margin businesses and build or buy proprietary capabilities that differentiate them from their competitors.

Defense contractors are facing a historic period of uncertainty and retrenchment. For many contractors the shrinking procurement budget is an imminent threat. Each defense contractor will have to develop a response to this change. Many small and midsized companies may find that strategic mergers bringing together the resources of midsized firms with the intellectual capital of smaller firms to be compelling.

The scope of the challenge

While the final results of the sequestration and continuing resolution negotiations remain to be seen, they will certainly result in significant overall reductions in defense spending: The Department of Defense (DoD) appropriation is presently the largest single line item in Federal Government discretionary spending and a very visible target. Given the lack of consensus for controlling entitlement spending and the obligatory interest payments on the federal debt, the defense budget will be squeezed hard. While the base budget in nominal dollars may increase, spending measured in real dollars adjusted to a FY 2013 base will be flat even if additional sequestration cuts do not happen.

The total FY12 Procurement budget was $120.5 billion; the FY13 Procurement budget is projected to be $108.5 billion; this $12 billion decline is the first bite of a multi-year reduction in funding; $6.5 billion of the FY13 Procurement reduction comes out of the war budget (what the Pentagon coyly calls “Overseas Contingency Operations” or OCO). However, in 2014 the OCO budget is “to be determined” and it is likely that procurement will take another big hit.

| Fiscal Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Base Budget (nominal $) | $531 | $424 | $534 | $546 | $556 | $567 |

| Overseas Contingency Operations | 115 | 88 | to be determined | |||

| Base Budget (real $FY13) | 538 | 525 | 527 | 531 | 530 | 529 |

The budgetary changes are unfolding in concern with (and partially responsible for) a epochal redefining of U.S. defense goals, away from having the capacity to fight and win two major regional wars simultaneously to fighting one war while confronting “an additional aggressor by denying its objectives or imposing unacceptable costs.” In addition, the expected U.S. withdrawal from the Afghanistan theatre in 2014 will allow the Pentagon to shift its budget priorities to sustain the heralded geopolitical pivot towards the Pacific Rim and China’s emerging military capability[1].

Naturally, these new strategic priorities are reflected in the budget: the budgets for the U.S. Navy, SOCOM (the Special Operations Command), unmanned aircraft and the Joint Strike Fighter program will be largely protected, while two of the U.S. Army’s heavy brigades will be withdrawn from Europe and the Air Force will lose six out of 60 of its tactical fighter squadrons.[2]

The strategic implications

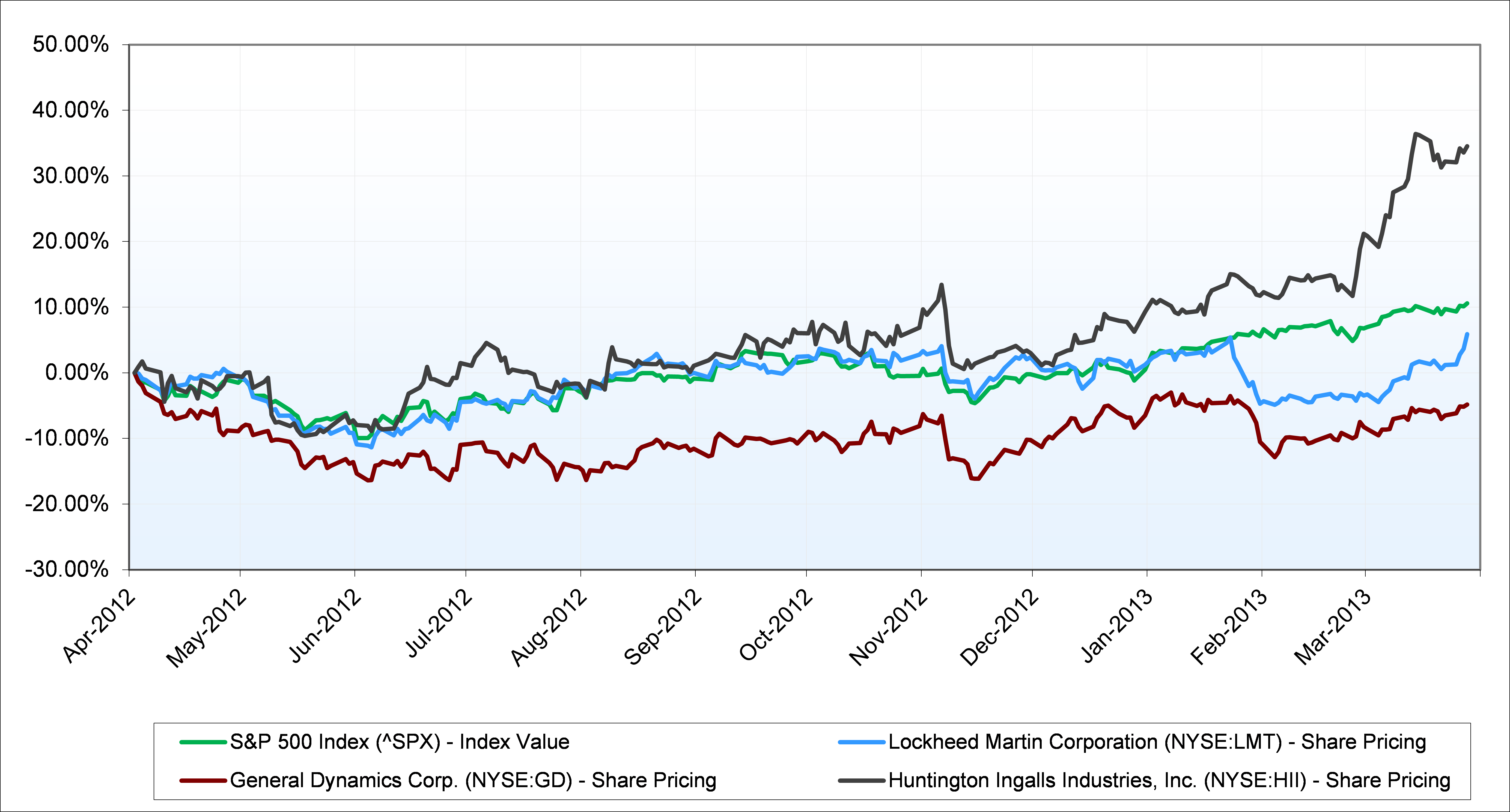

The fact that some sizable procurement programs with strong political backing will be protected suggests that many of the largest defense contractors will be able to successfully navigate the new budget landscape. This can be seen by examining the stock price of three major firms: Huntingdon Ingalls Industries (NYSE:HII), slated to build the next Navy carrier and Lockheed Martin (NYSE:LMT) and General Dynamics (NYSE:GD), which will be building additional littoral combat ships. Lockheed Martin is also running the Joint Strike Fighter program.

The stock prices of two large system integrators, General Dynamics and Lockheed Martin underperformed the Standard & Poor’s 500 index in the year to March 31st, 2013. Notable is a simultaneous dip in early 2013 just as budget sequestration became inevitable. In contrast Huntingdon Ingalls tracked above the S&P 500 for most of the year and then saw a significant jump in March 2013; this was probably related to the imminent announcement of a $2.6 billion contract to HII for building the Abraham Lincoln aircraft carrier.

But firms below the largest tier of defense contactors may not have the resources to weather a sustained downturn in defense spending. Consider Kratos Defense & Security Solutions, a midsized provider of technical support services for defense platforms. Kratos’ Chief Executive Officer, Eric DeMarco, laid out his company’s dilemma in a November 2012 earnings call, in which he noted that “traditional services business, which is approximately $100 million in revenue, continues to contract. And this contraction is expected to continue at least throughout all of 2013, due primarily to low-priced technically acceptable procurement decisions being made in virtually every government services-type contract award. This situation has been getting worse over the past several months as there are basically no new contract awards being procured and competition for existing work and recompete is fierce and is expected to remain so.”

In short, declining defense budgets will force government agencies to drive down margins for commodity services; the incumbent contractors will face lower profitability and market value. But if Kratos’ situation illustrates clearly the challenge to the midsized contractor, their response is equally instructive: In July 2012, they acquired Composite Engineering, Inc. for $155 million (a reported 1.65 times annual revenue and 9.8 times EBITDA). Composite Engineering (www.cei.to) makes target drones for the United States and friendly nations; the high-technology drones are used during pilot training and weapons testing. The acquisition provides Kratos with the capability to make drones and a product that will be purchased by militaries around the world to test next-generation weapons during peace and war. (It doesn’t hurt that a successful test of a new weapon system consumes the test drone.) More importantly the acquisition moved Kratos away from providing contract services and towards proprietary products.

The logic of the Kratos-Composite deal is reinforced by the fact that while the overall defense budget will face significant reductions, the Research, Development, Test and Evaluation (RDT&E) budget will only decrease 3.1 percent in 2013. This is an area in which highly technical small companies can shine with superior technologies and execution, even when programs are stretched over more years. Smaller, privately-held companies often have lower corporate overhead and can compete on contracts rates effectively as well. As a result, midsized companies can gain a roster of innovative products and services by acquiring smaller companies that have successfully leveraged their intellectual property into a market niche.

It is not surprising, then, that despite continuing uncertainty in the sector mergers and acquisitions continued at a normal pace; we identified 104 acquisitions of U.S defense companies in 2012, compared to 312 transactions in the whole of the past three years. The reported size of deals ranged from the $18 billion paid by United Technologies (NYSE:UTX) for Goodrich Corp. to $5 million paid by the Freedom Group for pistol manufacturer Para-Ordnance Manufacturing, Inc. Average enterprise valuations for these transactions were 1.5 times revenues and 11.8 times EBITDA[4].

Managers who want their businesses to survive and thrive over the next decade will have to thoughtfully divest low margin activities and consider acquiring capabilities that differentiate them from their competitors in future procurements. Entrepreneurs who own companies with proprietary technology, products and services that are aligned with the DoD’s strategic direction should see opportunities to sell all or part of their businesses at attractive valuations.

Contact:

For more information, please visit the Westbury Group, LLC webpage

Contact: Patrick L. Huddie, (646) 461-7470

[r2] About Westbury Group LLC

Westbury Group LLC, located in Westport, Connecticut, is an investment bank dedicated to providing superior financial and strategic advisory services for mid-market firms. Working on transactions ranging from $5 million to $250 million, Westbury Group’s financial professionals have a wealth of experience in a broad range of industries. Drawing on this experience and using specialized capabilities, Westbury Group’s teams assist clients with mergers and acquisitions, raising debt and equity capital and strategic counsel.

[3] Chart data provided by Capital IQ for the period 4/2/2012 to 3/28/2013

[4] EBITDA – Earnings before Interest Taxes Depreciation and Amortization.